In today’s trading landscape, having a trading bot isn’t enough. The real challenge is ensuring that automation aligns seamlessly with a trader’s strategy, adapts to market shifts, and executes with pinpoint accuracy. Consistency is the difference between random success and sustained profitability.

U.S. President Donald Trump has once again stirred discussions across global markets with his proposal to implement reciprocal tariffs — a policy that would impose the same tariff rates on countries that tax American goods at higher rates. While such a policy sounds fair in principle, the implications for global trade, diplomacy, and especially the financial markets, are more complex than they appear.

In an industry where prices shift in seconds and opportunities vanish just as quickly, having a competitive edge is more important than ever.

TNQ’s TNQ token has hit a major milestone by breaking $1 million in trading volume since it was just listed on Coinstore. This accomplishment shows that investors are becoming more engaged and interested in TNQ’s product.

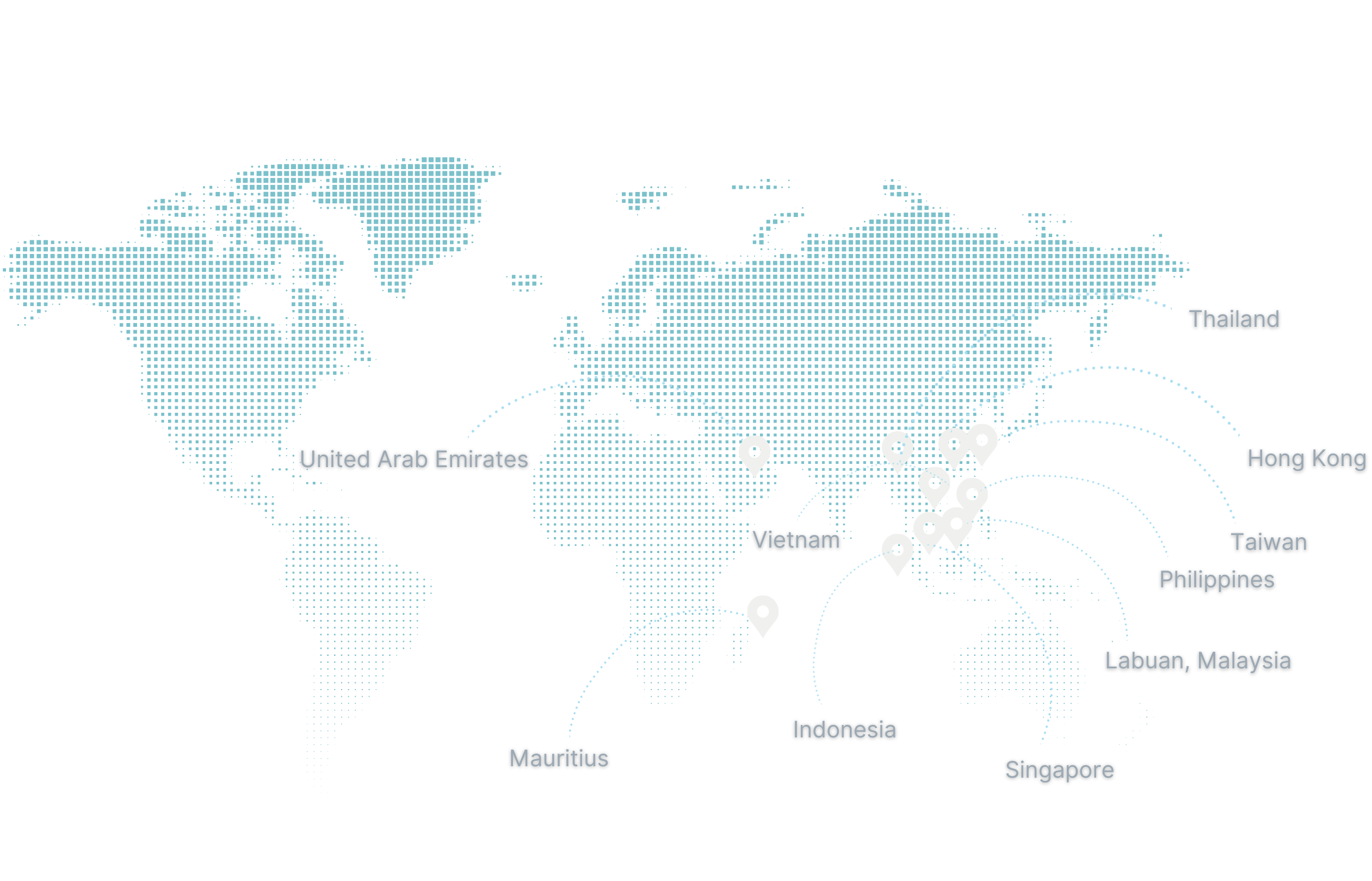

Dr. Jackie Chong, founder of TNQ, is on a mission to revolutionize the investment landscape with his visionary approach to digital asset tokenization. With over two decades of experience in institutional fund allocation, Dr. Chong is leveraging his expertise to democratize access to innovative investment opportunities through TNQ's groundbreaking initiatives.

In an era where trust and transparency are paramount, TNQ’s TNQ tokenization initiative stands out as a beacon of financial integrity. Powered by blockchain technology, TNQ embodies a commitment to transparency, revolutionizing the investment landscape and empowering investors with unprecedented visibility into their assets.